is it good when a stock is oversold

If a stock is oversold it means that the number of sellers outweighs the number of buyers. When a stock is overbought its usually expected that the market.

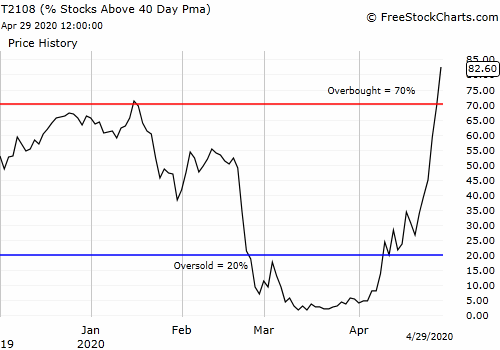

Stock Market Launches Deeply Into Overbought Trading Conditions Above The 40 April 29 2020 One Twenty Two Trading Financial Markets

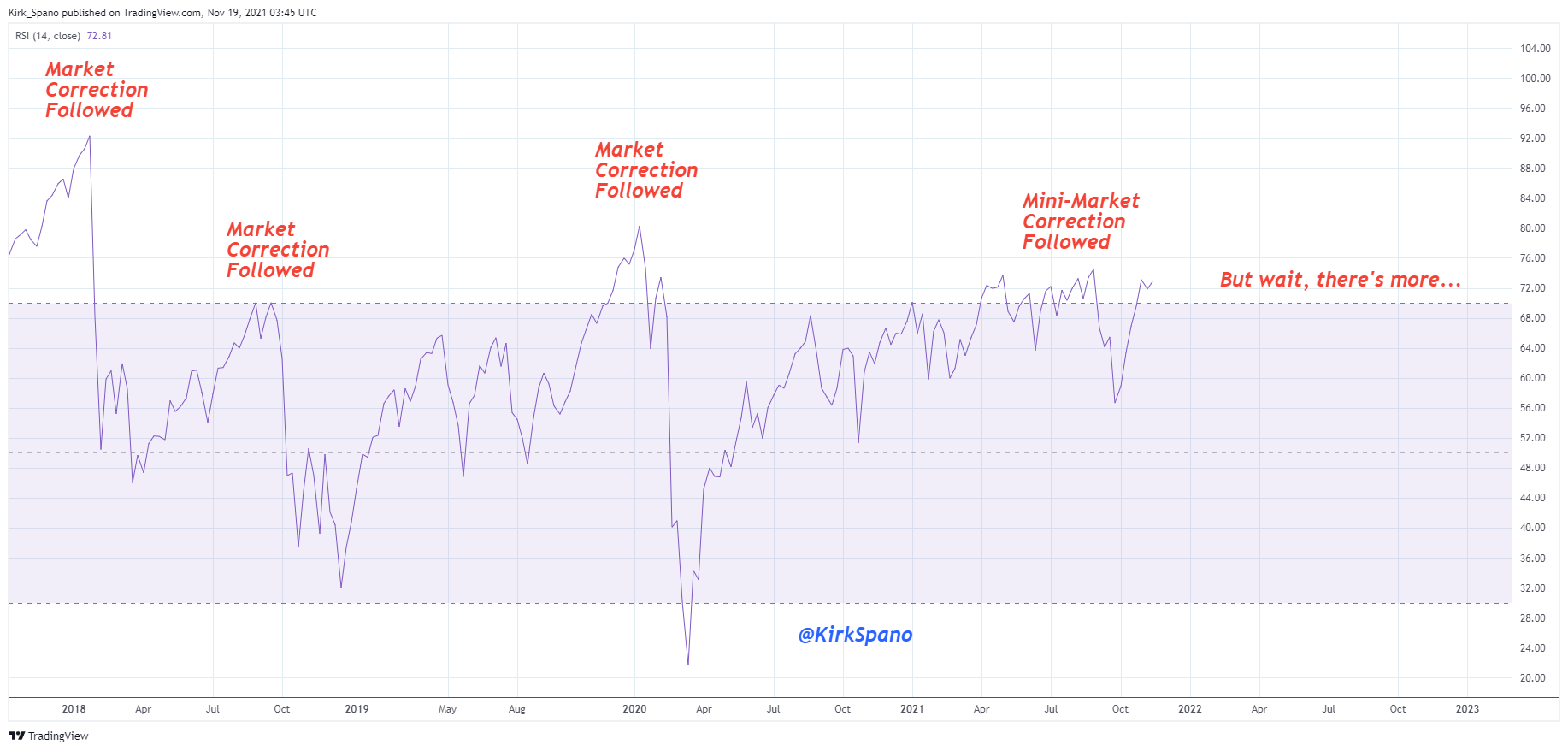

When a stock is overbought its usually expected that the market will correct itself and move to a lower level.

. Bollinger Bands Are Used In Combination With A Moving Average But Short Term Traders Will. The purpose of RSI is to let you know if a market or stock is overbought or oversold and may. An oversold condition can last.

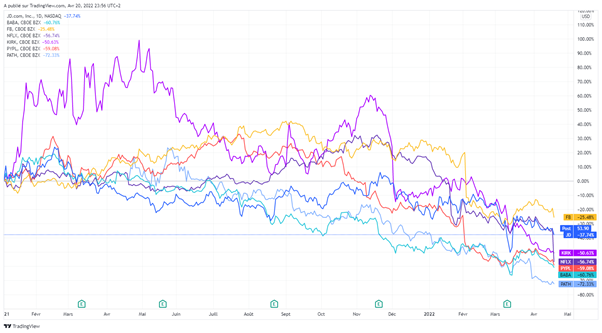

Any level below 30 is oversold while an RSI of over 70 suggests the shares are. 1 day agoBuy these 26 retail stocks on their way to recovery as bearish investors oversold them ahead of the holiday shopping season according to Morningstar. An overbought stock is one that is trading at a price above its intrinsic value.

When a stock becomes oversold though its a good thing for new investors. When a stock becomes oversold though its a good thing for new investors. The RSI is a technical analysis momentum indicator which displays a number from zero to 100.

Note stocks can remain overbought or oversold for long-ish periods of time. Answer 1 of 4. Identifying stocks that are overbought or oversold can be an important part of establishing buy and sell points for stocks exchange-traded funds options forex or.

But in the long term returns gravitate toward the average returns. When a stock becomes oversold though its a good thing for new investors. Oversold is a term used in the stock market that describes how high selling activity can actually drive down a securitys price to below its true value.

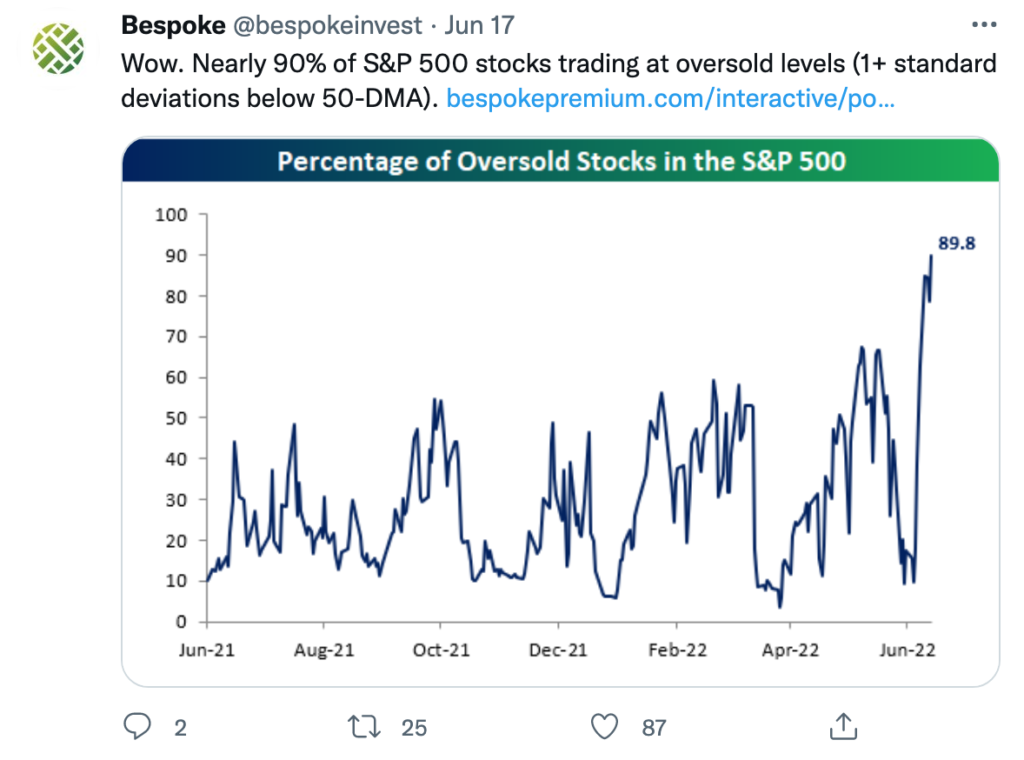

When stock markets are oversold we can expect strong returns over the next few days. A big company might be about to release bad news. Is it good to buy oversold stocks.

Oversold is a term used to describe a stock that has lost price value sharply and steeply. This stock may move much during the day volatility and with periodic low trading volume this stock is considered to be high risk. This could be the result of bad news regarding the company in.

Many technical analysts use what is called stock oscillators such as Stochastic. It is only one piece of information of the many that should inform your decisions. Fundamentally oversold stocks or any asset are those that investors feel are trading below their true value.

An oversold stock is considered cheaper than it should be and can be a great opportunity to get a favorite stock at a discount price though. 4 hours agoThe good part is that the market is just breathing after a long run-up and there is a good probability of an upside breakout. Citigroup is oversold on RSI14 19.

This can happen for many reasons such as. However we are seeing profit-booking in the broader.

7 Oversold Stocks To Buy Before They Rebound Investorplace

How To Find Overbought Or Oversold Stocks Easy

How To Buy An Oversold Stock By Tom Willard Youtube

Zachary Scheidt Blog The Stock Market Is So Bad It S Great Talkmarkets

Oversold Stocks Intraday Marketvolume Com

:max_bytes(150000):strip_icc()/dotdash_Final_Oversold_Dec_2020-01-83bb8abb9e44484986e604f4bcbacc5a.jpg)

What Oversold Means For Stocks With Examples

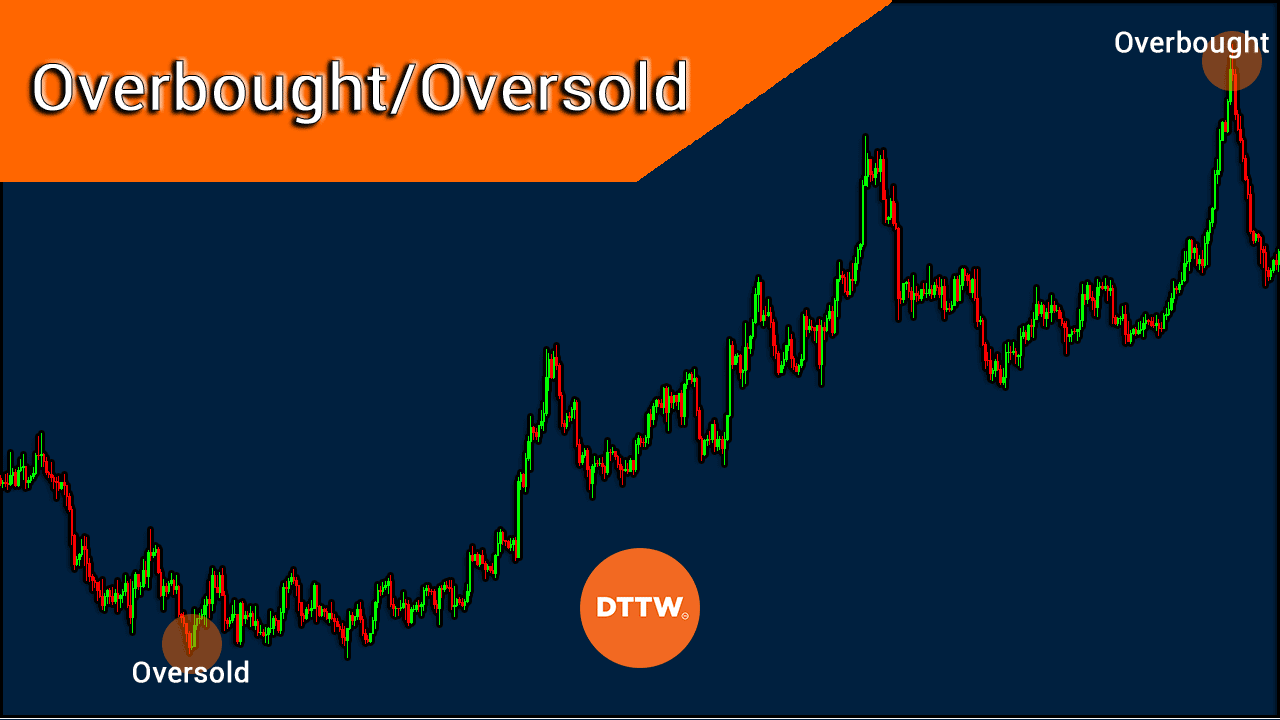

Overbought Vs Oversold And What This Means For Traders

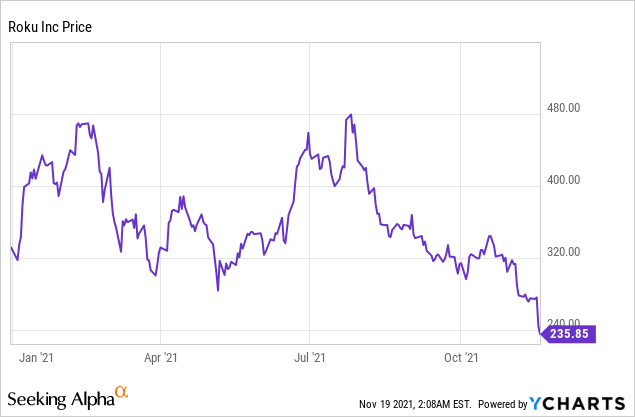

Overvalued Overbought Overleveraged Market While The Fed Tightens What Could Go Wrong Seeking Alpha

Identifying Overbought And Oversold Levels In Stocks Dttw

How To Find Oversold Stocks Meaning Indicators And Examples

Opinion You Should Be Concerned When This Stock Market Indicator Gets As High As It Is Now Marketwatch

10 Oversold Stocks That Could Explode Higher At Any Moment Seeking Alpha

Determining Overbought And Oversold Conditions Using Indicators

Oversold Stocks Most Oversold Stocks Today

You Are Probably Using Rsi Indicator The Wrong Way Warrior Trading

10 Oversold Stocks Due For A Bounce Investorplace

:max_bytes(150000):strip_icc()/dotdash_Final_Overbought_or_Oversold_v1_Use_the_Relative_Strength_Index_to_Find_Out_Oct_2020-03-ae0f093024284192a4d6fb105e78339e.jpg)

Rsi Indicator Buy And Sell Signals

Forget Warning Signs Stocks Are Now Extremely Overbought Seeking Alpha